Since the oil price slump in 2014, it has become more imperative for companies in the industry to embrace digital; using new technologies and processes to drive financial and operating performance. In the last few articles in our Swings and Roustabouts series, we looked at the history of cyclical oil prices, and where the upstream oilfield services and midstream sectors currently find themselves. In this episode of our series, we take a look at one of the dominant strategies being employed by these companies: digital transformation. Specifically, the digital oilfield, and its newest iteration, the digital oilfield 2.0.

The connection between technology implementation and strategic and financial success has become clear. Companies who fail to keep up falter: An Accenture survey of Canadian organizations in 2017 found that 51% of companies considered to be less profitable have not yet started to think about becoming a digital business. Those who are hungry for innovation thrive: look no further than the advancements in operational technologies that unlocked shale and tight oil plays throughout North America.

While these technologies unlocked new extraction potential, it also created a supply glut — which along with the international battle for market share and the lower cost of extraction, is expected to keep a lid on prices for years to come. These factors have created a new paradigm; one in which competitive advantage will not stem from who can produce oil the quickest, but who can best optimize the means of production to drive down costs. Digital technologies within the oilfield are best positioned to achieve that goal.

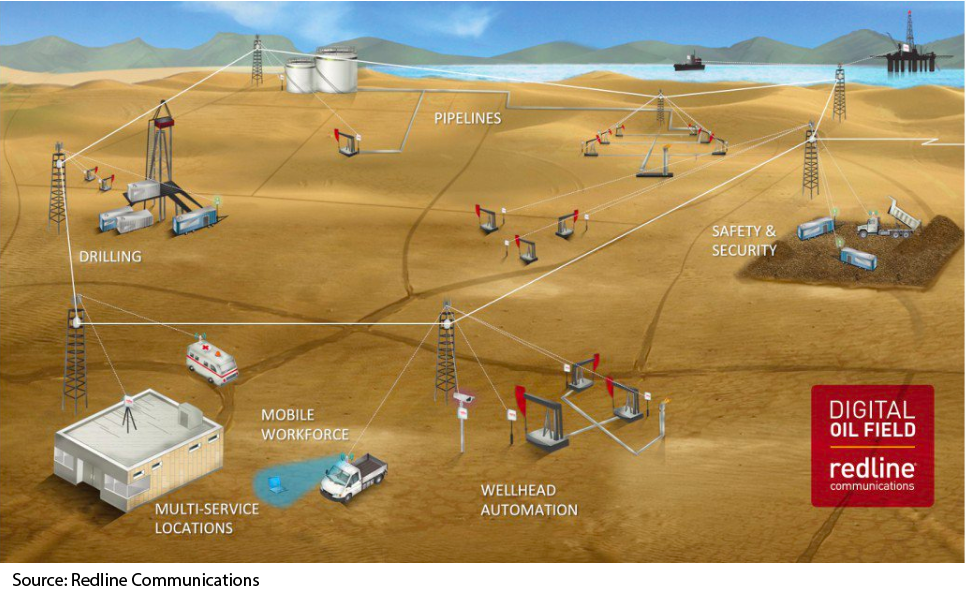

What is the digital oilfield? At its core, digital oilfield refers to combining business process management with digital technologies to automate workflows for maximizing productivity, reducing costs and increasing safety within oilfield operations. Implementing a digital oilfield makes for a more efficient company and safer work site. The digital oilfield is also not a place, as an article in GEO Expro puts it:

“…is better described not as a physical presence, but as a concept, encompassing not just data being streamed from far distant wells, but the processing, integration and analysis of that data in a number of physical environments.”

The digital oilfield can be further explained by delving into three aspects: the reasons it became a focus within the industry, highly cited use cases and the benefits to a company that employs a digital oilfield.

Reasons for the digital oilfield

Digital oilfield is a concept that intersects technology, data, automation, and people. In its simplest form, the digital oilfield allows companies to do more with less. This ability to do more with less is at its core why the digital oilfield came to be. By integrating technology, data and processes, companies can leverage existing resources (people) more effectively. They are also able to make better-informed decisions, increase operational efficiency and decrease HSE risk.

In the early 2000s, a need arose for high-performance computing power for seismic processing and imaging, and reservoir characterization and simulation. Geophysics became the first area of the industry to adopt digital solutions to achieve operational goals. Adoption within the industry was very slow, with other business units not following suit for a while. Around 2006, more cross-collaboration started taking place and units within drilling and completions started adopting technology such as sensors and measurement while drilling (MWD) and logging while drilling (LWD) systems.

Fast forward to 2014, and the industry experiences its biggest downturn in a generation. To survive, companies were implementing lean strategies and going through downsizing and/or abandoning projects. While this may have slowed some of the progress of the digital oilfield, companies also adapted by learning to do more with fewer resources.

The low oil price, having a reduced headcount and having severe margin pressure within the industry became drivers of the digital oilfield. Companies needed to embrace technology and digitization to survive the downturn. The low oil price and margin pressure meant that costs needed to be drastically cut. A consequence of this was widespread layoffs, and this reduced headcount forced companies to find a way to reduce the time taken by mundane manual tasks. This problem forced companies across the industry to embrace digital as a way to accomplish this.

Digital oilfield use cases

Having been under development for over a decade, many digital oilfield technologies are field proven and already paying dividends for early adopters, offering not only improved efficiencies and cost savings but additional benefits in areas such as health and safety and environmental compliance. In a cost-constrained environment, increased efficiency is all the more critical as a means to survive through a prolonged down cycle.

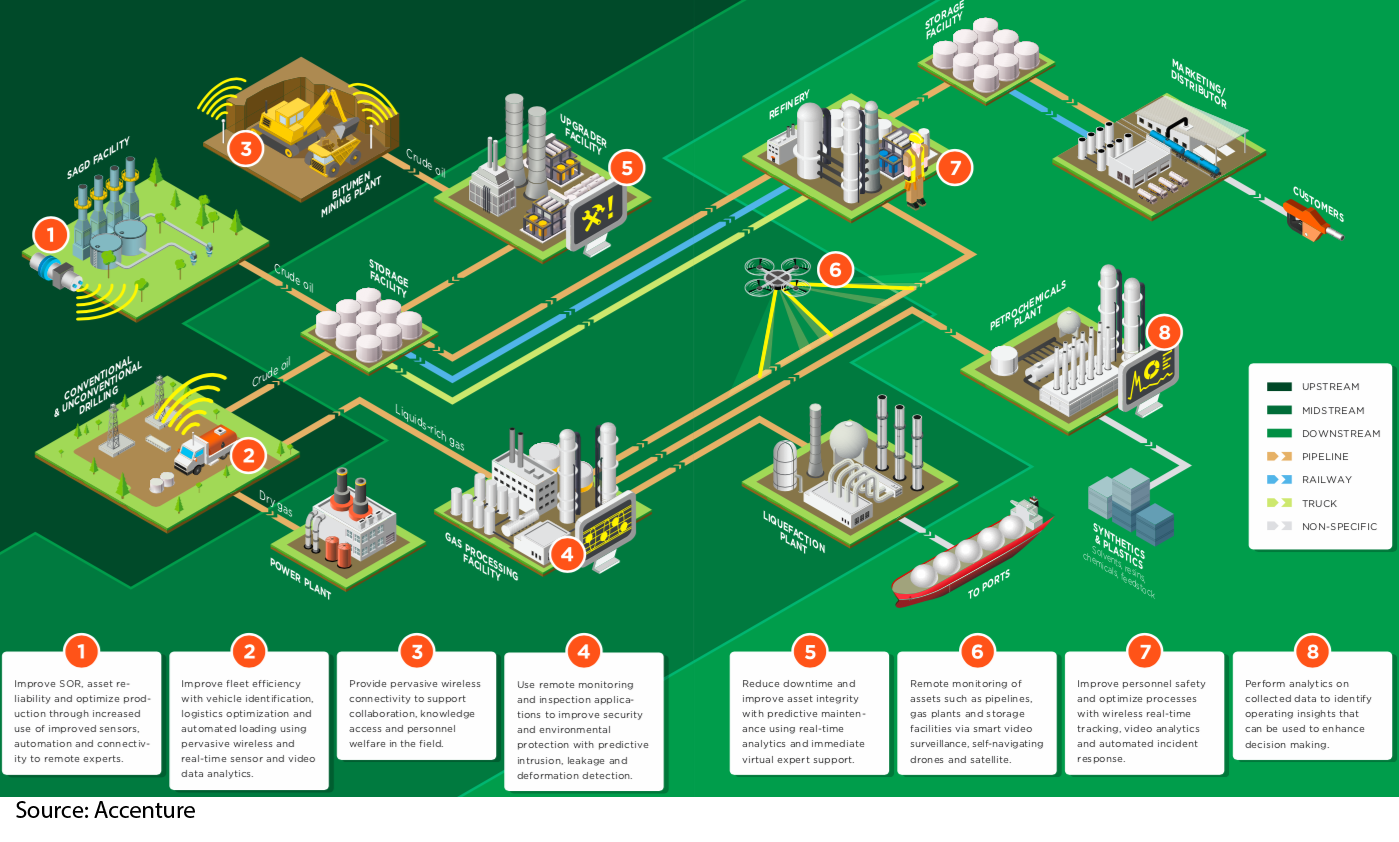

In their Digital Oilfield Outlook Report, Accenture identify 10 use cases that best exemplify the digital oilfield. These are discussed below.

- Remote Asset Monitoring: the two-way flow of operations-critical data allows companies to remotely monitor and control equipment such as compressors and flow meters, detect and diagnose problems, and optimize operations.

- Remote Asset Operations: machine-to-machine interface and real-time connectivity at remote facilities allows routine operations and troubleshooting to be overseen by experts centralized at head office.

- Predictive Maintenance: Utilizing predictive data analytics and condition-based maintenance approaches to improve asset availability and reliability. This Reduces or prevent operations interruptions and plant shutdowns due to critical component failure.

- Production Asset Optimization: Utilizing specialized sensors to monitor equipment and data analytics to identify improvements in complex operations and improve operational performance. This allows the company to automate routine processes, monitor and diagnose production issues and enable proactive asset management to optimize inputs and enhance recovery.

- Remote Asset Inspection: Improve the monitoring and performance of assets, and ensure any upsets (e.g., leaks, spills) are minimized through preventative measures and reduced response times.

- Automated Production Asset Optimization: Robotic or other automated equipment performing operating, assembly and maintenance tasks in continuous and safety-critical operating environments.

- Fleet Management: Obtaining real-time data - through the use of wire- less networks, sensors and video analytics - from on-board sensors to improve asset identification, tracking, utilization and logistics operations. By doing this the company optimizes labor productivity, reduces travel requirements, improves supply chain and procurement functions, minimizes input material and energy costs, and manages assets more efficiently.

- Field Productivity: Maximizing worker efficiency by providing wireless mobility that enables on-demand access to field data, engineering drawings and inventory tracking, and communication with centralized operations experts. This enables field staff to be fully connected to the head office and able to track and control assets remotely.

- Biometric Monitoring: Using wearable devices capable of continuously monitoring employee location, movements and other indicators in real time, to provide feedback to workers and detect dangerous situations such as gas leaks and accidents.

- In-Field Manufacturing: Operating portable manufacturing equipment to reduce downtime from critical part failure by producing specialized components/parts on site and on demand.

Benefits of the digital oilfield

Employing a digital oilfield has numerous benefits for the oil and gas industry. Firstly, companies are able to drive down costs of production even while the industry has a decreased headcount. By automating many repetitive manual tasks, the limited labor force can actually focus on work that drives revenue. IHS Cera have calculated that by using digital oil field processes, companies could realize up to 25% savings in operating costs, up to 8% higher production rates, 2–4% lower project costs, and as much as 6% improved resource recovery, all within the first full year of deployment.

Companies are also able to move from predictive to preventative maintenance processes. This reduces maintenance costs, decreases asset downtime and extends the life of the asset. Production and HSE incidents being averted are being averted before a failure to minimise expensive downtime for rigs.

Digitization also allows for the monitoring of production targets on a well-to-well basis and alert in advance if a well is unlikely to hit its expected production target. Course adjustments or fixes can now be made before a well’s output has been seriously diminished. Timely information leads to better decisions and productivity gains, while an increase in the number of remotely operated fields decreases the risk of accidents, with fewer people traveling to, and working in, potentially dangerous environments.

Another important benefit is the driving of operational excellence within the organization. In previous episodes of the Swings and Roustabouts series, we discussed what companies in the upstream and midstream oilfield service industries are currently doing. Achieving operational excellence has been a common thread throughout all those discussions. The digital oilfield plays an important role in helping companies achieve financial and operational excellence. This is usually a consequence of all the benefits listed above being realized through the implementation of digitization in the field.

The digital oilfield 2.0

The digital oilfield 2.0 is the result of the evolution of the digital oilfield as newer technology has been introduced, more companies embrace digitization and new challenges have arisen within the industry. Thanks to the industry becoming more mature in the digital space, companies have a clearer idea about how to use digital resources. This can, as a recent story in Information Age put it, “generate deeper insights from data to drive digital transformation projects, to extend asset life; maximize return on capital employed and drive additional profit.”

New concepts such as big data, machine learning, artificial intelligence (AI) and internet of things (IoT) are making their way into everyday vernacular, even within the oil and gas industry. These are newer technologies that companies are starting to implement as part of the digital oilfield 2.0. Each holds fantastic opportunities for the industry and companies embracing these technologies. One example is in the area of directional drilling, where the use of smart bit technology with machine learning and AI is providing engineers with more data about subsurface conditions so they can make informed decisions in real-time to guide the drilling process and improve drilling efficiencies and economics.

Challenges of Digital Oilfield 2.0

While these new technologies (referred to by some as ”Industry 4.0” technologies) bring great benefits to the companies that implement them, they face a few challenges. The first of these, as was the case with digital oilfield 1.0, is creating a culture of embracing change. Everyone within the organization, from the C-Suite to the field worker need to be willing to accept the implementation of these new technologies. A culture of change is at the centre of good technology adoption. In 2003, speaking about the first wave of the digital oilfield, Dick Cooper (the leader of Deloitte’s oil and gas practice at the time) said: “It will take more than just the new technologies… it will require the alignment of strategy, structure, culture, systems, business processes and, perhaps most important, the behaviors of people.”

Coupled with this challenge is the big crew change happening in the industry. The new generation of workers entering the industry are very comfortable using technology, while the previous generation is more averse. For digital oilfield 2.0 to be a success, both generations would have to embrace the change as soon as possible, especially if the company wants to gain a competitive edge.

Technology vendors also need to be mindful of the role they play within the digital oilfield 2.0. Within this new paradigm, vendors are expected to not just provide technology, but also ensure that their customers achieve business success with it. They must be able to work with a client who is diagnosing a field and determining what digital technology can do, all the way through planning and execution – to ultimately deliver business value. Companies such as JourneyApps are already doing this.

In conclusion

Digital transformation is driving forward the evolution of the digital oilfield. New technologies, a more mature buying market and the forces applied by the oil price means that what was once considered the norm for the digital oilfield is changing. While the foundation laid by digital oilfield 1.0 remains imperative for companies to stay competitive, the importance of data and the new technologies making their way into the industry will drive forward a new digital revolution.

Next in our Swings and Roustabouts series, we will take a look at how the midstream oilfield service industry is at the forefront of this digital revolution.